- Article

- Innovation

- Digital Transformation

- Digital Assets

The 10x potential of tokenisation

Democratising investment opportunities

Introduction

Tokenisation has the potential to unlock access to a wide range of assets for a new demographic of investors.

Tokenisation, powered by distributed ledger technology (DLT), has the potential to accelerate progress on one of the most pressing challenges facing the world today – reducing global wealth disparities.

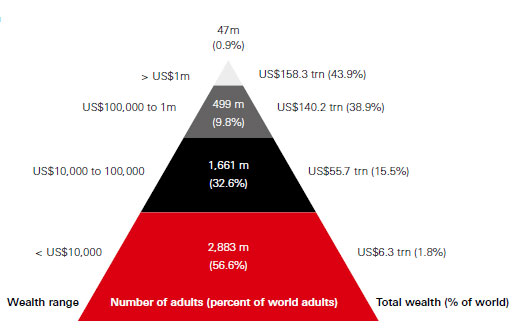

The total market size for global fixed income and equity was worth approximately USD178 trillion in 2019. Currently, 43.9 per cent of global wealth is held by 0.9 per cent of the world’s population.1

Global Wealth1

More than half the global population are at the bottom of this pyramid and collectively hold a mere 1.8 per cent of wealth. This group would benefit from affordable access to a wider range of investable assets.

In addition, a significant percentage of the population has limited access to banking services, severely inhibiting their ability to save and accumulate wealth. The world’s population stood at 7.8 billion in 2020,2 of which 3.46 billion were part of the labour force.3 However, 1.7 billion adults remain unbanked.4 Tokenisation could open up investment opportunities to large, under-banked populations, supporting the United Nations Sustainable Development Goal of reducing inequality.

Granted, several other factors need to be in place for these populations to gain access to tokenised assets. Many of the unbanked lack the necessary infrastructure; not everyone has secure internet access, a customer credit profile or the required financial and digital literacy. The increase in smartphone usage and digital banking in Southeast Asia, however, suggests that this part of the population may well be on its way to such a reality. In the region, higher internet penetration rates and a growing middle class have helped drive financial inclusion.5 Additionally, countries such as Thailand and the Philippines are implementing digital identification for all their citizens,6 while India has also introduced a centralised Know Your Client (KYC) repository with five national KYC Registration Agencies.7 These will be trustworthy sources for customer credit profiling.

What is asset tokenisation?

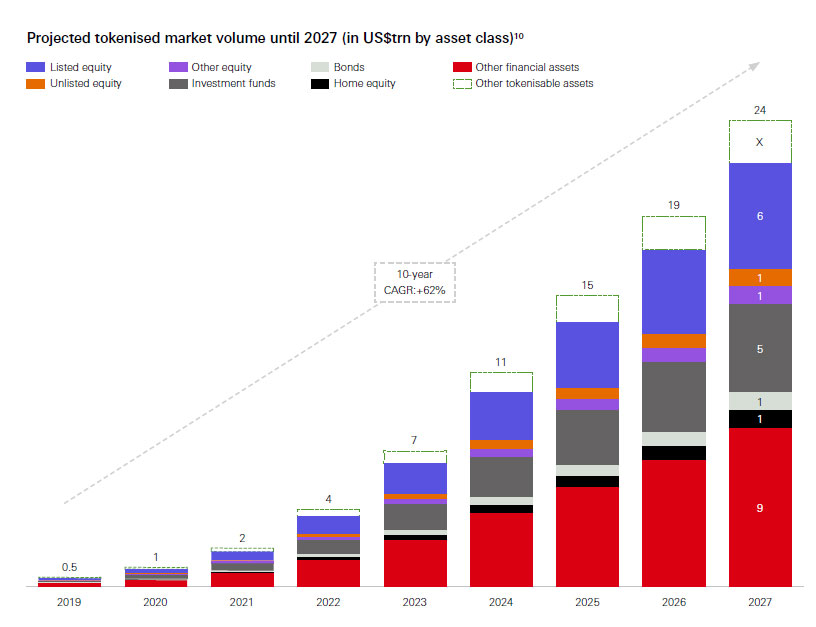

The financial services industry is waking up to the transformative potential of DLT; it is estimated that USD1.7 billion per annum is currently spent on DLT in financial services globally.8 The World Economic Forum estimates that up to 10 per cent of global GDP will be stored and transacted via DLT by 2027 – tokenised markets could potentially be worth as much as USD24 trillion by 2027.9

For DLT’s potential to be fully realised, financial market participants and infrastructure providers need to collaborate to galvanise change.Putting it all up for grabs

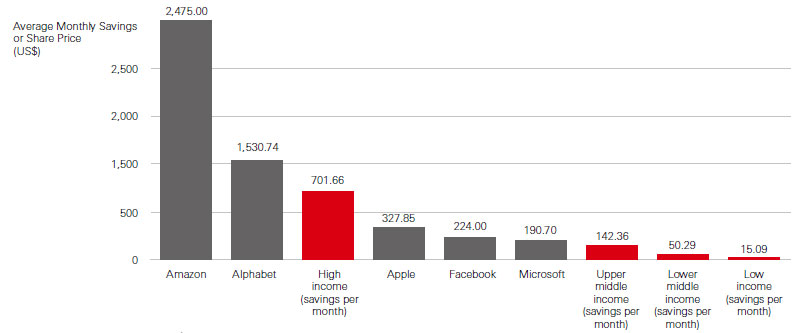

Investment is usually seen as the privilege of the mass affluent, and for good reason.

More than 84 per cent of the world’s population will need to save for more than two years to be able to afford a share in each of the top five market cap companies. Imagine if anyone could buy 1/10th or 1/100th of a share in a large cap company such as Apple or Amazon. This fractionalisation would make it much more affordable for a much larger part of the population to participate in the equity markets. Sounds impossible? Regulations permitting, affordability of investments might be possible in the near future with the use of DLT.

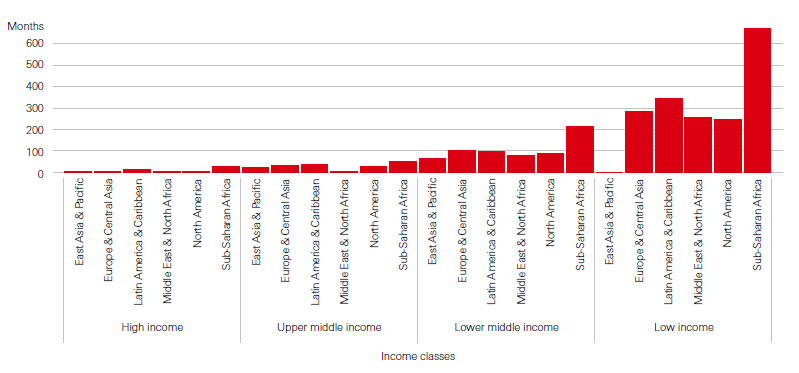

Average monthly savings of each income class compared to the price of each top five market cap company share

Months of savings required to own a share in each of the top five market cap companies

Savings = Average GDP per capita in US$ (World Bank). Average Gross Savings Rate by region (World Bank).

Top 5 market cap companies refer to Microsoft, Amazon, Apple, Alphabet (Google) and Facebook.

Share price = 52wk high as of 4 May 2020 market close.

Top 5 market cap companies refer to Microsoft, Amazon, Apple, Alphabet (Google) and Facebook.

Share price = 52wk high as of 4 May 2020 market close.

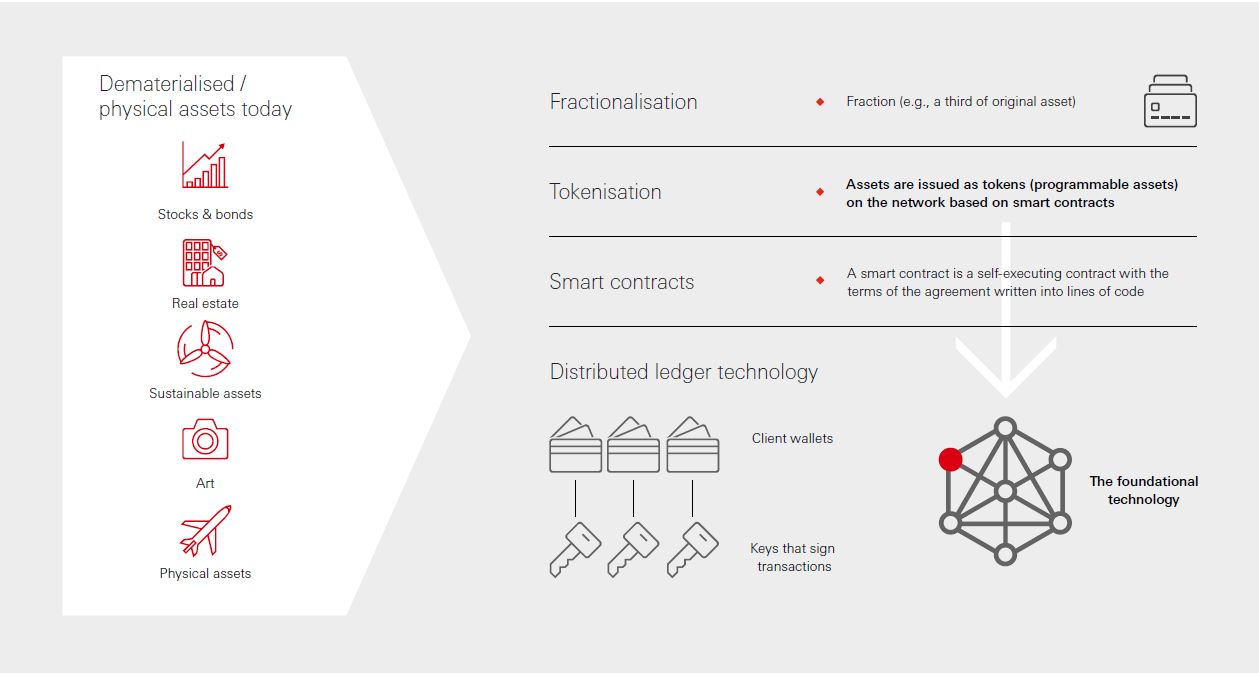

So how do we get there? Through DLT, a broad range of assets can now be issued as tokens (programmable assets) via smart contracts on a distributed ledger. Each token represents legal ownership of the underlying asset. As tokens are highly divisible, each token can represent a tiny fraction of any asset. This enables fractional ownership, increasing accessibility to the securities market by allowing for a wider scope of eligible investors due to pared down minimum investment amounts.

The average monthly savings (USD15) in low income countries is sufficient to meet the estimated minimum investment sum on many investment platforms.11 The rising middle class and increasing popularity of investment applications also suggest that micro-investing is a viable option for those with lower disposable incomes. By the end of 2018, 588 million users of Alipay in China had already placed small amounts of money in its mutual fund Tianhong Yu’e Bao.12 As of June 2019, its assets under management stood at USD150 billion.13

Tokenisation also enables fractional ownership of illiquid or alternative assets that traditionally require a high capital investment and hence have a limited investor base, such as real estate, private securities and art. Investors can hence benefit from a wider range of asset choices due to increased affordability, facilitating portfolio diversification, while sellers would benefit from their assets having greater liquidity. In short, tokenisation has the potential to give rise to a new demographic of investors, creating increased accessibility and augmenting the universe of investment options available.

Financial inclusion

Advancing financial inclusion is an objective of the Libra Project, a permissioned blockchain digital currency project proposed by Facebook. The Libra Association has extended its initial approach, and now aims to offer single currency stablecoins in addition to a multi-currency digital coin. Libra will be a catalyst for tokenisation when it takes off.

Challenges

Compliance

Transactions involving tokenised assets would need to meet the same standards on ‘Know Your Customer’ (KYC) and Anti Money Laundering (AML) as transactions carried out via traditional means. The speed, efficiency and irreversibility of transactions on a distributed ledger means that current highly manual operational controls and checks need to be replaced by automated compliance checks. Some companies have developed specialised utilities to manage compliance checks. Examples include: Harbor,14 a compliance platform built to ensure tokenised securities comply with existing securities laws and Rate3 Network,15 a protocol that handles asset tokenisation and identity management on Ethereum and Stellar blockchains.

Regulatory environment

International regulatory alignment is essential for the growth and development of tokenisation. There has been growing clarity in recent years as regulators globally implement governance frameworks and policies to regulate the emerging tokenised economy.

Regulators in several jurisdictions such as China, Singapore, Switzerland and Hong Kong are exploring the use of tokenised currency – central bank digital currency for use cases ranging from payments, settlement, to cross-border trade. China’s central bank is one of the most advanced, having rolled out a pilot of its digital currency in four cities.

Qualified custodians

Custodian services in the tokenised securities world are important in giving issuers and investors confidence that their assets are managed securely. The custodian’s role of safekeeping would be very different with tokenised assets. Ownership of tokenised assets is authenticated by means of a ‘private key’, which prevents theft and unauthorised access to tokenised assets. (A private key is a piece of code that is known only to the owner, and it gives the owner the ability to sign a transaction). The custodian’s role would be to securely store and manage these keys. However, only a few qualified custodians are licensed to store tokens on behalf of institutional investors. There is also a lack of standardisation in the requirements for digital asset custody licenses across jurisdictions.

A handful of companies have managed to secure regulatory approval, including Coinbase, Gemini and BitGo, which are regulated qualified custodians in the US. Major institutional players in the asset management and servicing space have also recently begun to offer custody solutions for the emerging tokenised economy. In November 2019, HSBC launched Digital Vault, a custody blockchain platform to digitise the transaction records of private placements. USD20 billion of private placements assets (including equity, debt and real estate), will be moved to the platform, allowing global custody clients to now access their records in real-time. Fidelity has launched the Fidelity Digital Asset Services platform for securing, trading and supporting digital assets. Further growth and development of digital asset custody solutions as well as standardisation of licensing requirements are critical to spur the growth of the tokenised asset ecosystem.

Executing a shared vision of change

The financial sector has become cognisant of the diverse benefits tokenisation can bring, evidenced by increased DLT activity. Engagement with a range of partners will become ever more vital in discovering promising DLT solutions. A case in point: HSBC Singapore, Cargill and ING executed the world’s first live trade finance transaction on R3’s scalable blockchain platform, Corda, in May 2018. In November 2019, HSBC Singapore announced a partnership with SGX and Temasek (a sovereign wealth fund) to explore the issuance and servicing of fixed-income securities.

We believe DLT is at a tipping point. Within the next five years, we expect DLT to achieve adoption at scale in the capital markets, and potentially replace core market infrastructure.16 This will change the shape of technology spending – and in the process, exert growing influence over the way markets function, ultimately improving inclusion for the under-banked.

Asia in focus

Asia is an ideal test bed for tokenisation, and is home to a population that would benefit from the increased transparency and accessibility to the securities market. Asia Pacific will be responsible for the overwhelming majority (90 per cent) of the 2.4 billion new members of the middle class entering the global economy. The bulk of that growth will come from the developing markets of China, India and throughout South-East Asia.17 It is also home to the highest number of internet users,18 a population that is comfortable with using cryptocurrencies19 and cashless payments,20 and a growing young, middle class with economic influence.21 Yet on the other hand, the same region has witnessed rising income inequality22 – the Gini coefficient level for Asia is now higher than the average for the rest of the world.23 Given the rapidly growing digital accessibility (especially through increasing smartphone ownership24) in this region, we believe that there is immense potential in this market that DLT can help to unlock.

Act now

We see tokenisation as the enabler to lower the barrier of entry to investing for more than half of the world’s population, by paring down the minimum investment amounts required. DLT can also give investors access to assets that traditionally would require high capital investment (real estate, private securities, art), augmenting the universe of investment options available. For this to happen, compliance, regulatory and custody challenges have to be addressed. It is encouraging that many countries and organisations have taken steps to better understand asset tokenisation and its significance, and the potential is there for tokenisation to make buying and holding assets ubiquitous, allowing for individuals at all income levels to grow their wealth.

In the words of Astro Teller, Captain of Moonshots, Google X: “It’s often easier to make something 10x better than it is to make it 10 per cent better.” DLT has arrived, propelling the rise of tokenisation and thus enabling the market to be 10x more efficient, 10x more inclusive, 10x more resilient. To do this requires taking the path less trodden and to undertake risk of failure for a larger payoff. The past decade of banking focused on making the 10 per cent improvements; now is the time for the industry to pull together to commit leadership and governance to tackle challenges proactively and pursue the opportunity to make the 10x difference.