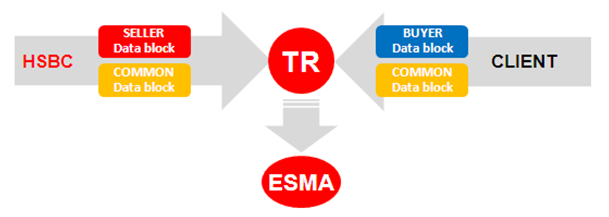

Trade repository reporting is one of the key requirements of EMIR. The objective is to provide regulatory authorities with transparency in the derivatives markets to facilitate identification and mitigation of systemic risk.

EMIR requires the reporting of all derivatives contracts to a Trade Repository (TR). TRs are entities regulated by ESMA that centrally collect and maintain the records of all derivatives trade related data.

In-scope counterparty types for Trade Reporting include:

- NFC- (Non-Financial Counterparty below the clearing threshold).

- NFC+ (Non-Financial Counterparty above the clearing threshold).

- FC (Financial Counterparty).

Non-EEA (European Economic Area) counterparties generally do not have to report their side of the trades (whereas the EEA counterparties have to report their side) under EMIR.

In-scope products for Trade Reporting include:

- Over-The-Counter (OTC) derivative products including both cleared and uncleared.

- Exchange Traded Derivatives

- HSBC is including Foreign Exchange (FX) physically settled forwards as in scope until further guidance is issued