- Article

- Global Research

- General Research Insights

- Emerging markets

Not giving up on EM - HSBC Emerging Markets Sentiment Survey

- EM investors have become a little less bullish amid headwinds, but are still broadly constructive

- Our latest survey shows cash holdings stay at high levels, while risk appetite remains solid…

- …suggesting that investors are looking for opportunities, and not shying away from EM

Hanging in there

A pleasant surprise

Major investors have become a little less bullish about the outlook for emerging markets (EM) but remain broadly constructive on the asset class, according to our latest EM Sentiment Survey.

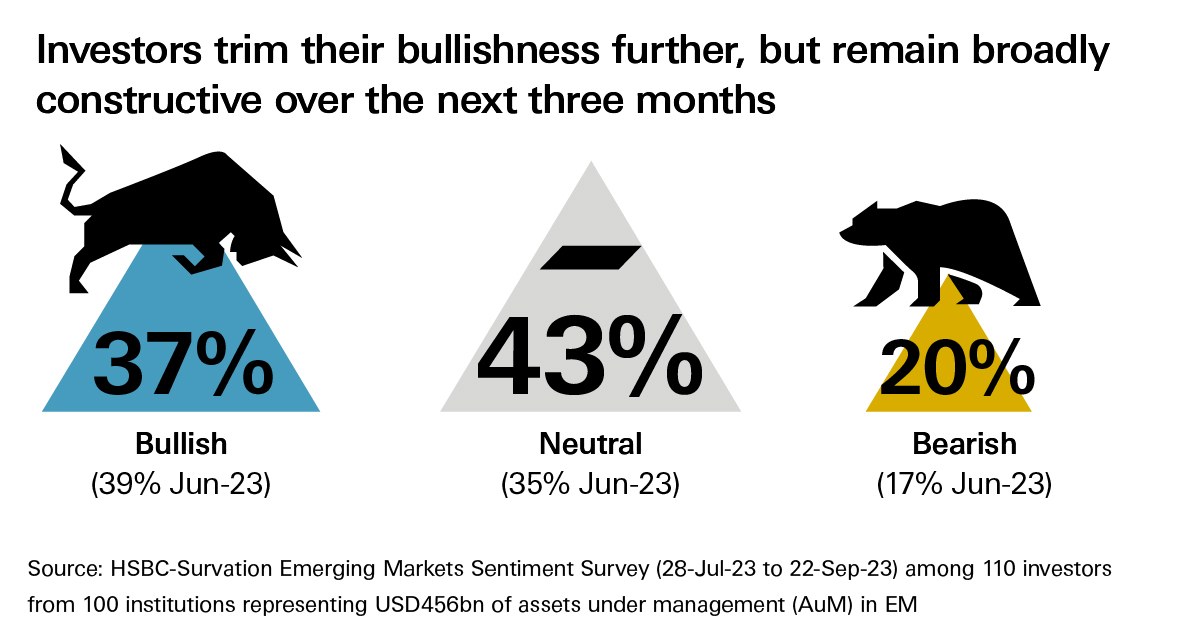

Despite heightened volatility in financial markets over the summer, 37% of EM investors feel “bullish” about the prospects for the next three months, down from 39% in our June survey, while 20% are now “bearish”, versus 17% earlier. This means overall net sentiment on EM is still positive, albeit less so than in our last two surveys.

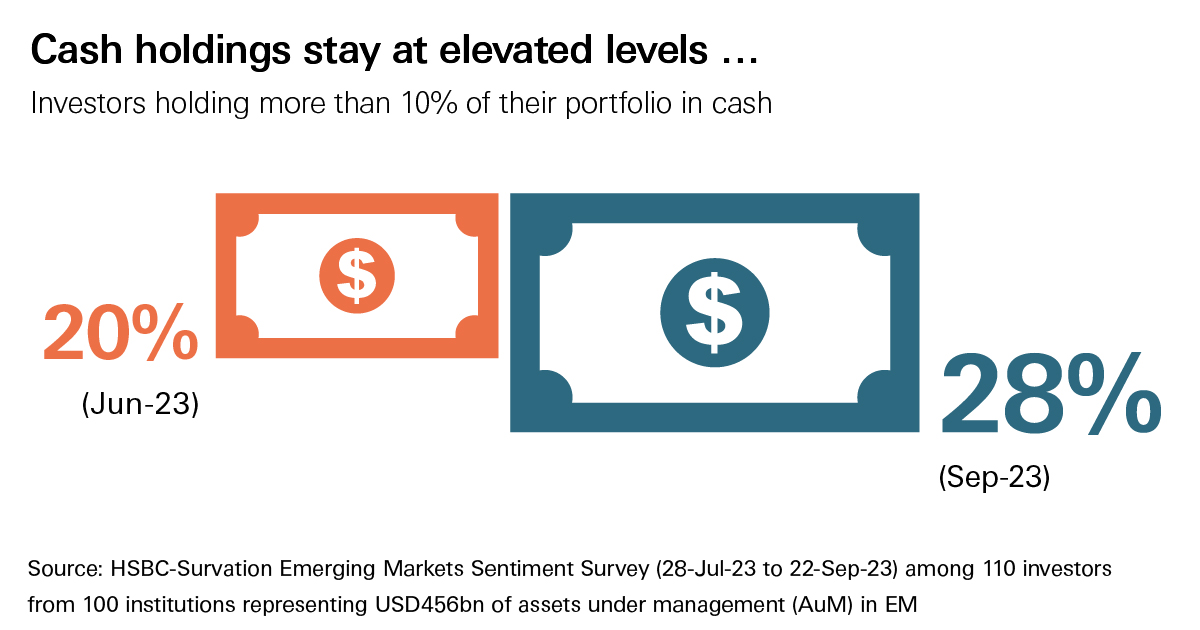

Investors appear to have dipped into their large cash piles as the weighted average cash level, as a share of assets under management, moderated to a still-high 5.7% from 5.9%. In a marked shift, 21% of investors are planning to add more to their cash reserves, which is the highest level in a year.

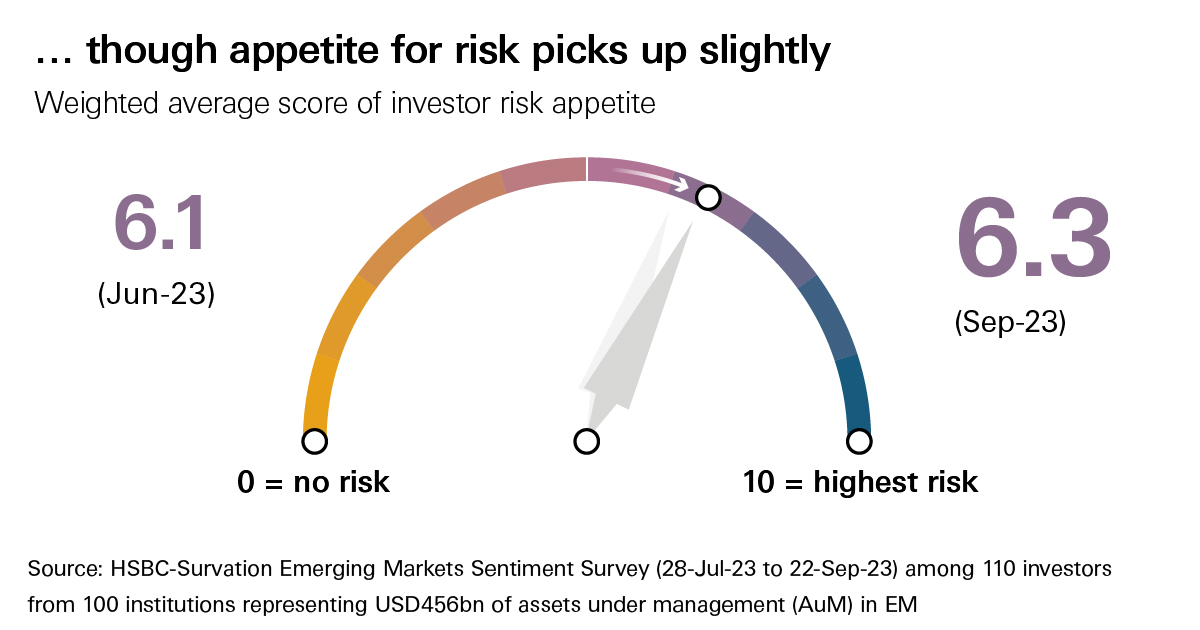

Meanwhile, their risk appetite score – measured on a scale where 0 is “no risk” and 10 is “highest risk in EM” – ticked slightly higher to 6.3 from 6.1 on a weighted average basis. This inclination to pile up more cash, while retaining a solid risk appetite, tells us that investors are still seeking opportunities rather than shying away from EM.

The survey was conducted between 28 July and 22 September among 110 investors from 100 institutions representing USD456bn of EM assets under management. The fieldwork coincided with an abrupt shift in the external environment with higher core rates, a stronger US dollar and rising food and energy prices all weighing on risk sentiment.

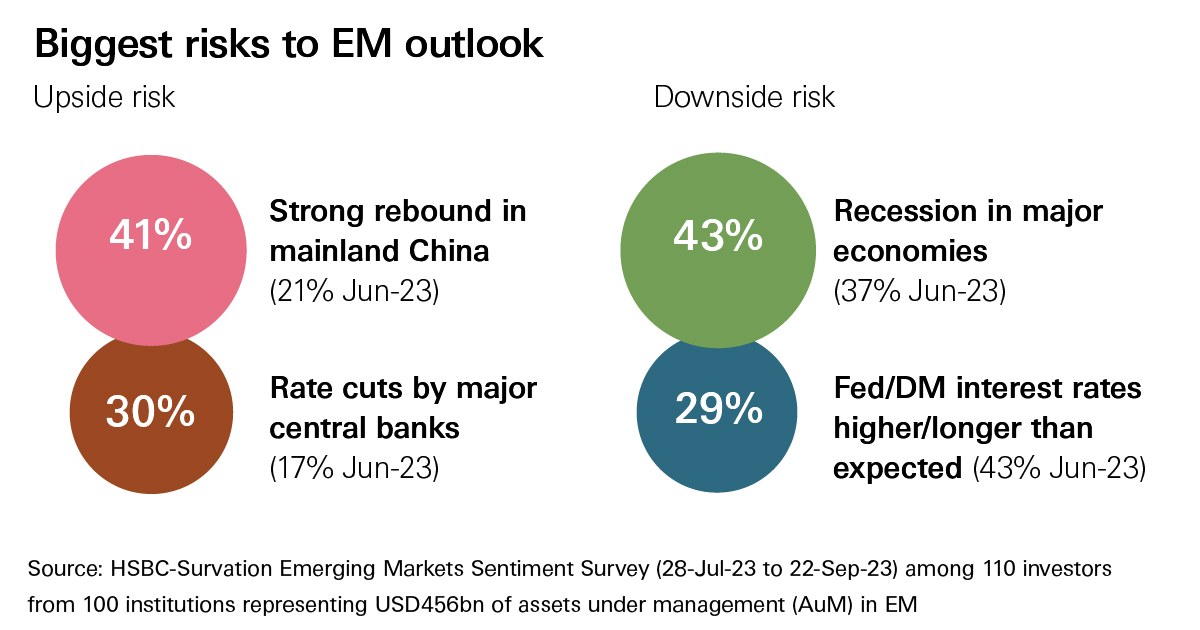

Against this backdrop, recession in major economies has replaced higher interest rates in developed markets as the single biggest perceived risk to the EM outlook. This may also reflect recent signals from policymakers that the end of their tightening cycles is near. By contrast, a strong rebound in mainland China has re-emerged as the main upside risk. Recent stimulus measures and an upcoming critical policy meeting might be rekindling these positive expectations.

Strategy

Investors are still upbeat about Latin America, which has outperformed other regions year-to-date. Asia remains their second-most favourite region, while the net sentiment on external debt has turned positive for Africa after a long time, which might be down to improving conditions in a few individual economies.

Investors have curbed their enthusiasm on the outlook for EM FX somewhat, most likely because of the return of US dollar strength. They have also trimmed their bullishness on local currency debt, while hard currency debt has made something of a comeback. The outlook on EM equities remains the most favourable among the asset classes, however, with 74% of the respondents expecting EM equities to be higher in the next three months. Some 60% expect EM equities to outperform developed market equities over the same period.

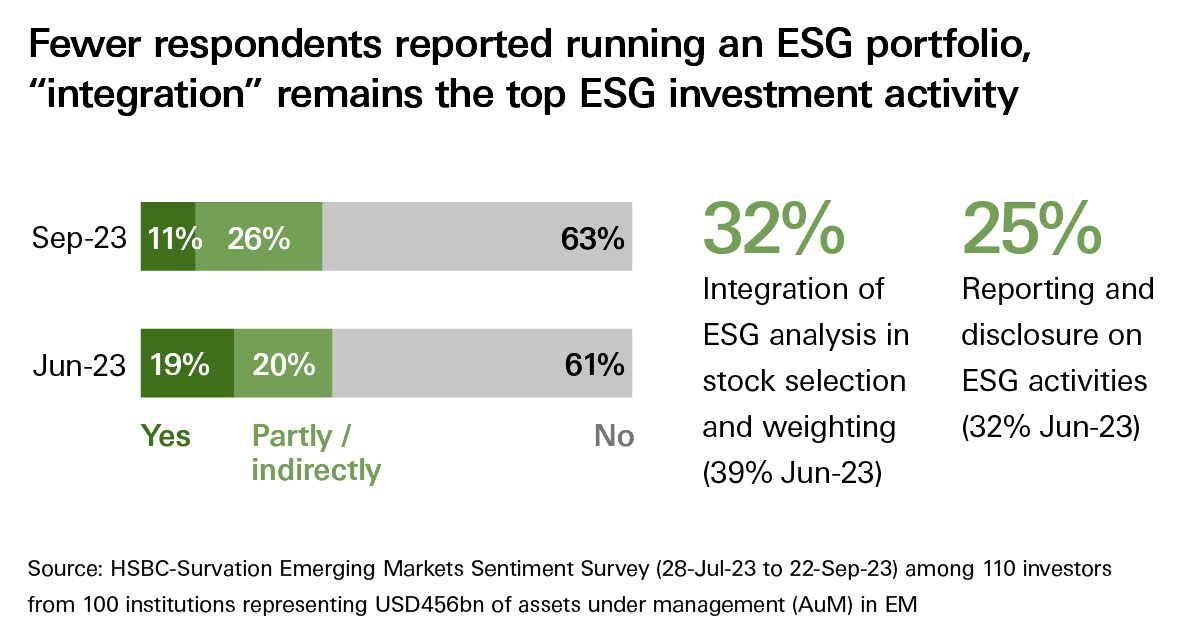

Engagement with environmental, social and governance (ESG) investing continues to moderate, with 37% of investors running an ESG portfolio, either directly, partly or indirectly, down marginally from 39% in June. Our ESG colleagues believe that many investors in the US are still, in fact, investing in ESG themes, but are not actively labelling their portfolios as ESG.

Would you like to find out more? Click here* to read the full report (you must be a subscriber to HSBC Global Research).

To find out more about HSBC Global Research or to become a subscriber get in touch at askresearch@hsbc.com.

* Please note that by clicking on this link you are leaving the HSBC Global Banking and Markets website, therefore please be aware that the external site policies will differ from our website terms and conditions and privacy policy. The next site will open in a new browser window or tab.

Global Research

HSBC Global Research provides information, insights and thought-provoking ideas.