- Video

- Global Research

- General Research Insights

The great relocation

- Recent trade shocks have spurred efforts to relocate production to alternative markets and closer to home

- We analyse how supply chains are reconfiguring globally, and to what extent production is reshoring and nearshoring

- As the world continues to fragment along geopolitical lines, global trade flows could follow suit, but this could take time

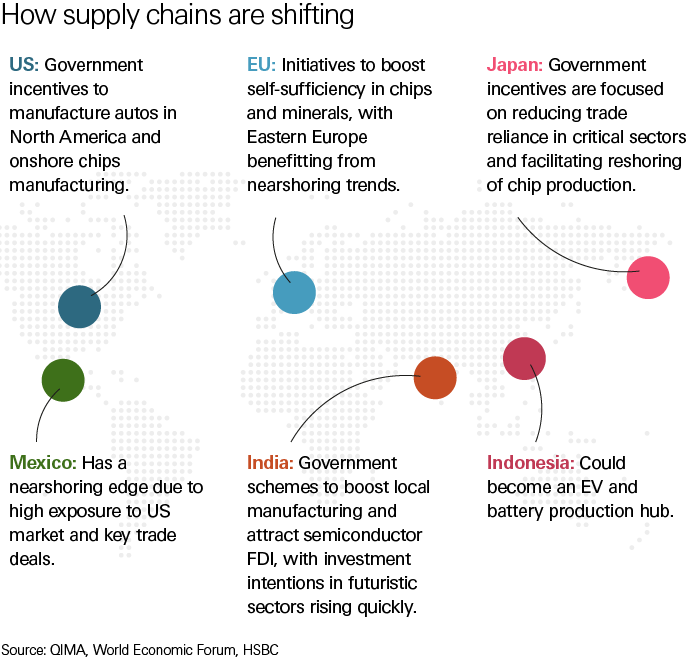

How supply chains are shifting

Trade connects the world, and those connections have grown significantly over recent decades. During the “hyperglobalisation” period (i.e., roughly 1992 to 2008) in particular, trade grew notably faster than GDP. But greater trade interconnectedness has also left supply chains vulnerable to sudden trade shocks.

Recent disruptive events have brought this vulnerability into focus. The escalation in US-China trade tensions in 2018, the COVID-19 pandemic, the Russia-Ukraine war and, most recently, vessel attacks in the Red Sea have all highlighted not only how reliant we are on the seamless movement of goods around the world, but also how fragile some supply chains are.

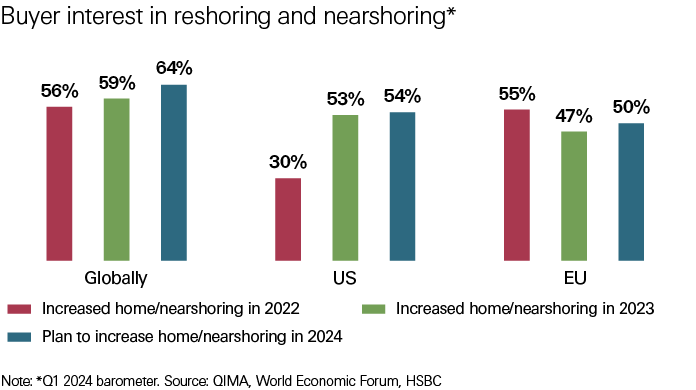

Against this backdrop, some businesses and governments have pushed to relocate production to alternative markets and closer to home. Building greater resilience in supply chains has been the order of the day. And today, as geopolitical risks remain rife, we are likely to see continued evolutions in trade policy, as well as further supply chain reconfiguration.

China’s changing role

Mainland China’s changing role is at the centre of this picture. The economy’s rise in global trade has been meteoric, growing from 0.9% of world goods exports in 1950 to 14% in 2022. Today, around 70 economies consider mainland China their top source of imports and more than 30 regard it as their number one export destination. It is now involved in 14 of the top 25 trade corridors (either as an exporter or importer), up from just six in 2003.

14%

Mainland China’s share of world goods exports in 2022

70

Economies consider mainland China their top source of imports

However, labour-intensive supply chains have been reconfiguring away from the economy for a number of years, largely due to rising labour costs. For example, as mainland China has moved into higher value-added supply chain activities, its share in emerging market labour-intensive exports has declined from 55% of total exports in 2015 to 53% in 2022.

Economies such as the US have also taken policy steps to reduce trade dependency on mainland China, with COVID-19 disruption only accelerating their efforts. Just last year, Mexico surpassed mainland China for the first time in over two decades to become the US’s top import source.

In 2023 Mexico surpassed mainland China to become the US’s top import source

Some foreign companies are also diversifying sourcing away from mainland China. For example, the number of Apple’s suppliers in mainland China has declined by 20% from 350 in 2016 to around 280 today, while the number of its Indian suppliers has more than quadrupled to 14 today.

The return of industrial policy

The focus on building more resilient supply chains has led to the return of industrial policy, with governments around the world announcing a range of policies and subsidies to support local production in critical sectors. US manufacturing construction spending in the electronics industry, for example, has surged 16-fold since January 2021 on the back of new semiconductor manufacturing investment. Japan has provided subsidies to the likes of TSMC and Micron to support semiconductor onshoring.

More shifts to come?

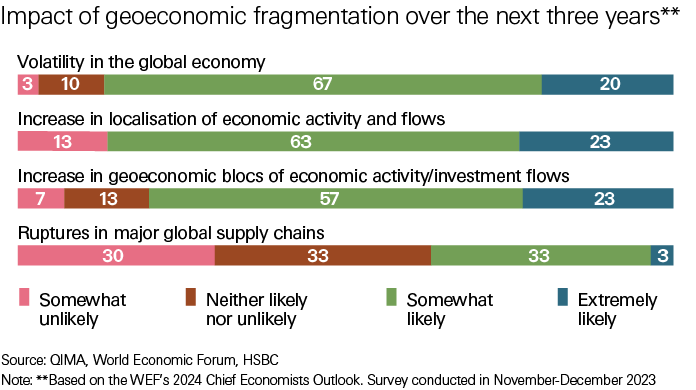

And there could be more supply chain shifts to come. According to recent business surveys, Western businesses are looking to reduce reliance on mainland China by relocating some operations to other markets in the region or closer to home.

However, mainland China remains an important market with many multinationals still committed to operations there. So, although there are some signs that production has started to shift to alternative markets, supply chains are still incredibly globalised. We think there will be limits as to just how much production could be nearshored and reshored in the medium term.

But with the world continuing to fragment along geopolitical lines and a swathe of government support measures up for grabs, there is no doubt that there will be more supply chain reconfiguration to come.

And only time will tell how the “great relocation” might pan out.

Want to find out more? In a recent edition of The Macro Brief podcast, Shanella discusses the ongoing evolution of global supply chains. Listen to the podcast* now.

To find out more about HSBC Global Research, please email us at AskResearch@hsbc.com

* Please note that by clicking on this link you are leaving the HSBC Global Banking & Markets Website, therefore please be aware that the external site policies will differ from our website terms and conditions and privacy policy. The next site will open in a new browser window or tab.

Global Research

HSBC Global Research provides information, insights and thought-provoking ideas.