Supporting trade in a new world order

Article

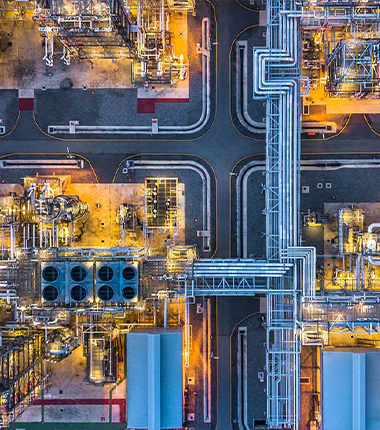

Economic ties between Asia and the Middle East are growing rapidly, and going well beyond their tra...

Explore HSBC's Transition Pathways which brings together industry insights and sector expertise to help business leaders act on their transition plans.

For more information, please contact your HSBC representative.