- Article

- Global Research

- Macro and rates outlook

China – facing headwinds and maintaining growth

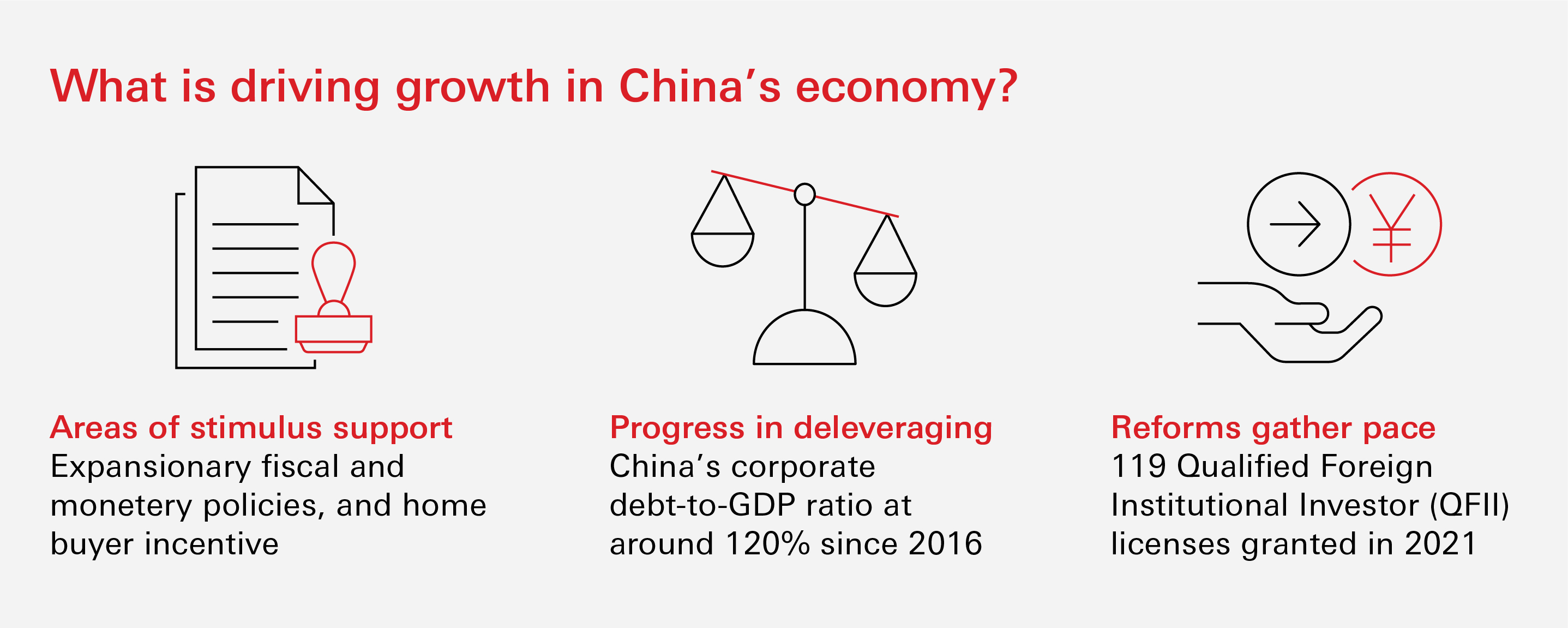

Stimulus measures, successful deleveraging, and ongoing financial reform will help China address its current economic challenges.

The evolving macroeconomic environment and its impact on China were discussed at the HSBC 9th Annual China Conference – a landmark event that explored the recent financial trends that will determine the growth trajectory of the world’s second largest economy. In a session focused on China’s macro outlook, an expert panel discussed that - although there are concerns about economic growth - they should not be overplayed.

Reasons for optimism

The panel discussed several factors that will support China’s economy for the rest of the year. For a start there is the pandemic response. With the zero-COVID approach likely to stay in place, going forward the policies will be more fine-tuned to reduce the economic impact. For example, Beijing’s pandemic response has been more targeted than Shanghai’s complete lockdown.

When it comes to monetary policy, China’s relatively low inflation leaves room for the central bank to introduce further cuts to the reserve requirement ratio, and even cut the policy rate in the coming months. The property market will also receive support as local governments relax measures on down payments for homebuyers.

Derisking the economy

Another area of progress in the Chinese economy is in deleveraging. This is an ongoing campaign to control debt levels that grew steadily in the years following the Global Financial Crisis in 2008. Deleveraging has proved highly effective, with the corporate debt-to-GDP ratio stable at around 120% since 2016, said Helen Huang, Head of China Onshore Credit Research, HSBC.

“China has managed to handle and contain the aftermath of several high-profile restructurings of sizeable and complicated corporates, which require very detailed coordination and execution,” said Ms. Huang.

She described how deleveraging has a pragmatic aspect, as its success means that the campaign can be put on hold when the economy is weak. In practical terms, this will result in private companies being granted easier access to funding than in previous years.

Financial reform pushing ahead

Despite the volatility in global markets, foreign investors are still capturing the opportunities that come from reformed access channels to onshore markets. Last year, a record 119 Qualified Foreign Institutional Investor (QFII) licenses were granted1 , following a revamp of the access channel in late 2020. This followed a revamp of the access channel in late 2020 that combined QFII with renminbi equivalent RQFII into a new initiative called the Qualified Foreign Investor programme.

“There are various access channels into onshore Chinese financial markets, each with their own advantages. QFI is attractive to foreign investors because it provides access to the entire universe of A shares, as well as the IPO market,” said Russ Jacobsen, Head of China Execution Strategy, HSBC. So compared to the list of approved stocks on Stock Connect, a QFI holder can trade the full range of innovative companies on the ChiNext and STAR markets, for example, as well as many other mid- and small-cap companies.

Another area of interest to foreign investors is the recent launch of the MSCI China A 50 Connect Index Futures in October 20212 , which is a new risk management tool that complements pre-existing listed futures in Singapore.

“Our main client interest in futures comes from asset owners seeking to hedge their QFII inventory, as we now see them doing this across Hong Kong and Singapore exchanges,” said Mr. Jacobsen, who also highlighted that the new futures have a high correlation to the underlying index.

Supporting growth

Going forward, improved pandemic restrictions could be streamlined and the likely increase of the stimulus measures could come into action, while a pause in deleveraging could allow some credit expansion. On the financial front, market reforms are proceeding alongside the introduction of more sophisticated financial products. Taken together, these factors will offer support to the economy as it faces ongoing macro headwinds.

Accessing Emerging Markets

Explore our latest insights on topics as diverse as macroeconomics, technological innovation, and the future of trade.